child tax portal phone number

Information from previous benefit payments. Our automated services for the following benefits and credits are available 24 hours a day 7 days a week.

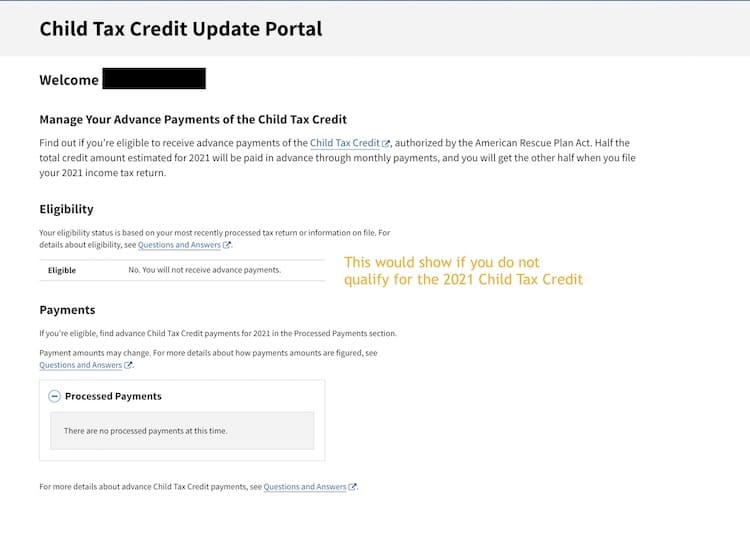

Child Tax Credit Update Portal Internal Revenue Service

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

. Individual Income Tax Attorney Occupational Tax Unified Gift and. Choose the location nearest to you and select Make Appointment. Telephone agents are available.

Do not use the Child Tax Credit Update Portal for tax filing information. For the September 30 2021 Advance. IMPORTANT INFORMATION - the following tax types are now available in myconneCT.

The number to try is 1-800-829-1040. The amount you can get depends on how many children youve got and whether youre. For example if you call the.

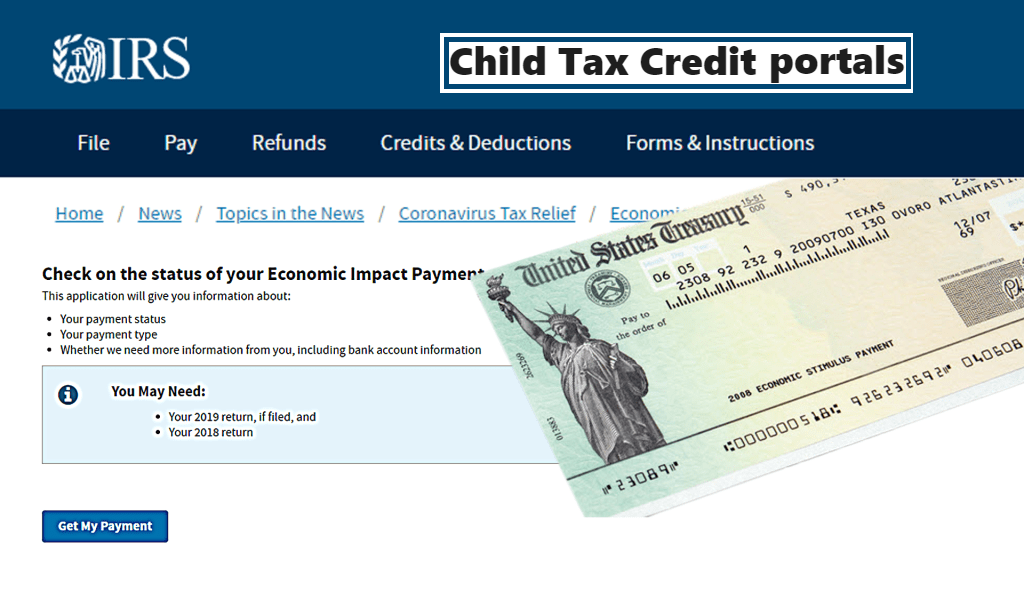

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Contact information child and family benefits. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment.

Here is some important information to understand about this years Child Tax Credit. Already claiming Child Tax Credit. Have been a US.

Including PIN requests setting up an online account filing a return on the Portal or making a Portal payment. Taxation Self-Service Portal Help. The credit amount was increased for 2021.

Make sure you have the following information. The Child Tax Credit CTC provides financial support to families to help raise their children. Making a new claim for Child Tax Credit.

Personal details about the children in your care. The Child Tax Credit provides money to support American families. Department of Revenue Services.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. Details from your account or an assessed return notice of. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially.

Child Tax Credit Health And Human Services Montgomery County

Accounting Aid Society Using The New Child Tax Credit Update Portal Families Can Now Unenroll From Advance Payments Meaning They Won T Get The Monthly Payments Set To Start July 15 And

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

2021 Child Tax Credit How To Claim It And File 2021 Taxes

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Child Tax Credit Resources Free Tax Services For Moms Let S Get Set

How To Access The Irs Child Tax Credit Update Portal Kindred Cpa

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Child Tax Credit Portal Now Open For Non Filers How To Claim Up To 3 600 The Us Sun

Taxnet Llc Child Tax Credit Payments Irs Online Portal Facebook

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What We Do Community Advocates

Irs Adds Address Change Capability To Child Tax Credit Portal Where S My Refund Tax News Information

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Tax Tip Tuesday Updated Information About Advance Child Tax Credit Payments Thunder Radio

Child Tax Credit Latest How To Use The Irs S Update Portal Cbs Philadelphia

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Irs Warns Child Tax Credit Portal May Have Wrong Amounts Accounting Today

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back